ETH Price Prediction: 2025-2040 Forecasts and Key Market Drivers

#ETH

- Technical Crossroads: ETH sits at pivotal support with diverging MACD/Bollinger Band signals

- Market Sentiment: Record open interest suggests impending volatility despite ETF outflows

- Long-Term Value: Network fundamentals may outweigh short-term price pressures

ETH Price Prediction

ETH Technical Analysis: Key Indicators and Price Outlook

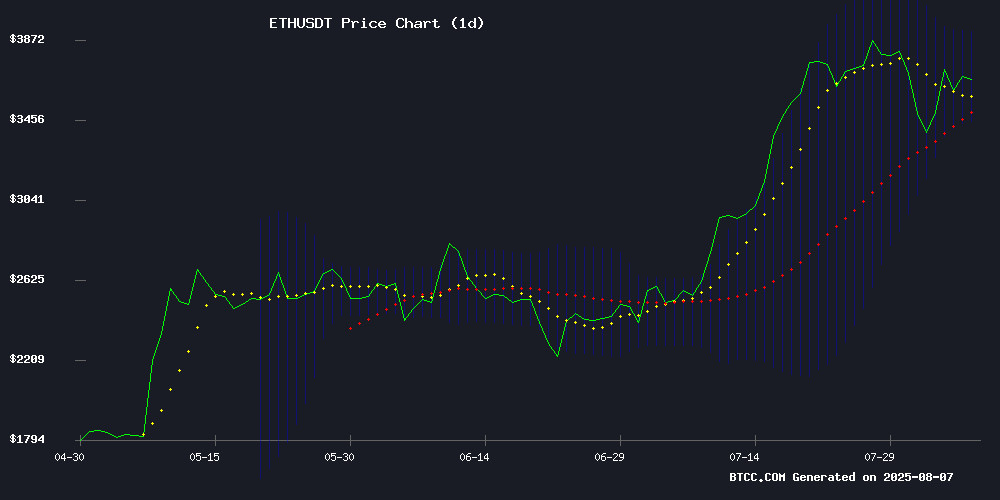

According to BTCC financial analyst Emma, ethereum (ETH) is currently trading at $3,675.50, slightly below its 20-day moving average (MA) of $3,685.12. The MACD indicator shows a bearish crossover with a reading of -16.7873, while the Bollinger Bands suggest a potential range-bound movement between $3,451.37 (lower band) and $3,918.88 (upper band). Emma notes that a breakout above the 20-day MA could signal a bullish reversal, but traders should watch for confirmation.

Ethereum Market Sentiment: Diverging Signals and Key Developments

BTCC financial analyst Emma highlights mixed sentiment in Ethereum markets. While bullish headlines like "Ethereum Price Eyes Upside Break Above $3,750 Resistance" contrast with concerns about "ETF Exodus" and "Sell Pressure," the underlying on-chain strength remains notable. Emma points to record-high open interest as a potential volatility catalyst, suggesting the market is approaching a decisive moment. Regulatory developments, including the SEC's stance on liquid staking, add another layer of complexity to ETH's near-term outlook.

Factors Influencing ETH’s Price

Ethereum Price Eyes Upside Break Above $3,750 Resistance

Ethereum has demonstrated resilience after finding strong support NEAR the $3,540 level, with bulls now pushing ETH toward a potential breakout above $3,750. The recovery follows a successful defense of the 50% Fibonacci retracement level from the recent swing low of $3,350.

Technical indicators suggest growing momentum, with ETH/USD breaking through a bearish trend line at $3,625 on the hourly chart. The pair now trades comfortably above both the $3,600 psychological level and the 100-hourly moving average, signaling renewed bullish conviction.

Market participants are watching the $3,720-$3,750 zone as the next critical resistance cluster. A decisive close above this barrier could open the path toward $4,000, while failure to hold $3,540 may trigger another test of lower support levels.

Ethereum Faces Divergent Signals Amid Sell Pressure and On-Chain Strength

Ethereum's market dynamics present a study in contrasts. The second-largest cryptocurrency recorded its second-largest daily sell-side imbalance ever, with Net Taker Volume plunging to -$418.8 million. This translates to 116,000 more ETH sold than bought in a single session—a pattern that historically precedes local tops.

Yet beneath the surface, bullish undercurrents persist. The asset continues to hold near $3,643 despite the selling pressure, suggesting buyers are absorbing the supply shock. Network activity metrics and long-term holder profitability paint a more constructive picture, creating tension between short-term technicals and fundamental strength.

The technical setup remains precarious. While ETH recently completed a textbook cup-and-handle formation, its failure to reclaim the $3,950 neckline leaves the pattern in jeopardy. The RSI's neutral 57 reading offers no decisive directional clues. Market participants now face a clear line in the sand—either swift recovery above $3,950 to confirm bullish continuation, or potential retracement toward lower support levels.

Ethereum Nears Make-or-Break Moment as Open Interest Soars to All-Time High

Ethereum's price has dipped 4% over the past week, trading at $3,598 amid broader market weakness. Despite the pullback, on-chain metrics reveal surging activity—Open Interest in ETH futures hit a record $77 billion on Binance, signaling heightened trader participation.

Network demand remains robust, with ethereum processing its highest-ever daily transaction volume. The divergence between price action and derivatives activity suggests mounting tension—capital is flooding in, but the $4,000 resistance level continues to loom large.

Such extreme positioning often precedes volatility spikes. Market makers are bracing for a decisive MOVE as ETH balances short-term technical pressure against long-term institutional adoption narratives.

Ethereum’s $10B Open Interest Wipeout and ETF Exodus: Market Implications

Ethereum shows early signs of distribution as its ETFs record historic outflows, coinciding with a drop below $3,600. The 10% retracement from recent highs appears to be a healthy market flush, eliminating weak longs and resetting overheated funding rates. Over $10 billion in Open Interest evaporated within ten days, signaling broad de-risking.

Notably, back-to-back $1 billion+ realized profit events suggest disciplined profit-taking rather than panic selling. Despite last week's 9.67% weekly decline—the first significant pullback in weeks—ETH has rebounded 4% this week, demonstrating resilient bid interest. BlackRock's acquisition of 23,000 ETH ($88 million) confirms institutional accumulation continues at these levels.

The market faces a critical test: whether such institutional demand can offset the OI contraction and declining whale participation (164 fewer whale addresses over 30 days). Binance's ETH/USDT longs exceeding 60% reveal a pronounced bullish bias among retail traders, setting up a potential sentiment clash.

Standard Chartered Favors Ethereum Treasury Firms Over Spot ETFs for ETH Exposure

Standard Chartered's Kendrick argues that publicly listed companies like SharpLink Gaming (SBET) provide superior Ethereum exposure compared to US spot ETFs. Since early June, these treasury firms have matched ETF purchases in ETH accumulation, with NAV multiples stabilizing near 1.0. "These firms offer regulatory arbitrage and direct exposure to ETH price appreciation, staking rewards, and increasing ETH per share," Kendrick told BeInCrypto.

Ethereum treasury companies have amassed over 2 million ETH since emerging earlier this year, with Standard Chartered predicting an additional 10 million ETH could follow. SharpLink Gaming's Q2 earnings report on August 15 is expected to shed further light on this growing asset class.

The NAV multiple—calculated as market cap divided by ETH holdings—now trades just above 1.0 for SBET, suggesting limited downside risk. "I see no reason for the multiple to dip below 1.0," Kendrick noted, positioning these firms as more attractive than spot ETH ETFs for investors seeking direct crypto exposure.

Base Network Disruption: Sequencer Glitch Halts Block Production for 33 Minutes

Base, Coinbase's Ethereum Layer-2 solution, faced a significant network disruption on August 5, 2025, halting block production for 33 minutes. The outage stemmed from unexpected on-chain congestion and a backup sequencer failure, requiring manual intervention despite built-in redundancy measures.

The incident rattled crypto markets, exposing vulnerabilities in Layer-2 infrastructure during peak demand. While Base's team resolved the issue swiftly, the event reignited debates about centralized sequencer risks versus operational efficiency in scaling solutions.

Market reactions were immediate, with traders scrutinizing ETH-based assets and competing Layer-2 tokens. The disruption comes at a critical juncture for institutional adoption, where reliability expectations clash with blockchain's experimental nature.

Ethereum Treasury Companies Outshine ETFs as Preferred Investment, Says Standard Chartered

Ethereum treasury companies have emerged as superior investment vehicles compared to ETH ETFs, according to Geoffrey Kendrick, Standard Chartered's global head of digital asset research. These firms now trade at normalized net asset value multiples just above 1, making them attractive for investors seeking ETH exposure.

Public entities holding ETH as reserve assets have accumulated 1.6% of circulating supply since June - matching ETH ETF purchases. Kendrick highlights their regulatory arbitrage advantage: "Given NAV multiples are currently just above 1, I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs."

The altcoin gained 3% following the report, with technical analysts eyeing a potential bullish pennant breakout if ETH conquers the $4,100 resistance level. The normalization of NAV multiples signals growing institutional sophistication in crypto investment vehicles.

Ethereum Price Lags Despite All-Time High In Daily Transactions – What’s Next For ETH?

Ethereum's blockchain has hit a record 1.55 million daily transactions, signaling robust network activity. Yet, ETH's price remains subdued, failing to breach key resistance levels. The divergence between on-chain metrics and market performance raises questions about near-term bullish momentum.

Unique Ethereum addresses surged to 332 million, suggesting growing adoption. Analysts note the disconnect between usage and valuation mirrors past accumulation phases. Market participants await catalysts to bridge the gap between fundamentals and price action.

Vitalik Buterin Prioritizes Sub-One-Hour Withdrawals Over Stage 2 L2 Decentralization

Ethereum co-founder Vitalik Buterin has shifted focus to reducing LAYER 2 (L2) withdrawal times to under one hour, declaring it more urgent than advancing to stage 2 decentralization. This comes as six major rollups—Base, Optimism, Unichain, Scroll, Ink, and Kinto—achieved full compliance with Stage 1 requirements. Buterin praised the progress but emphasized the need for faster withdrawals, which currently can take up to a week without intermediaries.

The prolonged withdrawal process forces users toward bridging solutions with weaker trust models, such as multisig wallets or multi-party computation (MPC), undermining Ethereum's decentralization principles. Buterin advocates transitioning from optimistic proofs to validity proofs (zero-knowledge or ZK proofs), citing significant advancements in ZK technology. He referenced ethproofs.org to highlight ongoing developments and proposed a hybrid "2-of-3" proof system to accelerate withdrawals.

SEC Commissioner Challenges Liquid Staking Interpretation in Regulatory Clash

SEC Commissioner Caroline Crenshaw has issued a sharp rebuke of the Division of Corporation Finance's stance on liquid staking, calling its recent guidance legally unmoored and factually dubious. The August 5 dissent highlights growing tensions within the regulator as crypto-native financial products test existing securities frameworks.

Crenshaw's statement dismantles the Division's claim that certain liquid staking arrangements fall outside securities regulations, arguing the analysis rests on "wobbly" assumptions divorced from market realities. The critique carries particular weight given Ethereum's transition to proof-of-stake, which has made staking services a focal point for regulatory scrutiny.

The public rift emerges as the SEC grapples with applying decades-old securities laws to decentralized finance innovations. While the Division's staff interpretation sought to provide clarity, Crenshaw warned market participants against relying on what she characterized as an unsupported and non-binding position.

Roman Storm Tornado Cash Verdict: Guilty on One Count, Two Left

In a landmark ruling with far-reaching implications for decentralized finance, Roman Storm, co-developer of privacy tool Tornado Cash, was convicted of conspiring to operate an unlicensed money-transmitting business. The verdict sends shockwaves through the crypto ecosystem as regulators continue their crackdown on privacy-focused protocols.

While two charges remain pending, this partial conviction establishes a precedent for developer liability in DeFi. Market observers note increased regulatory scrutiny could temporarily dampen innovation in privacy protocols, though long-term fundamentals for Ethereum and other smart contract platforms remain strong.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC analyst Emma provides these ETH price projections:

| Year | Conservative | Base Case | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $3,200 | $4,100 | $5,800 | ETF flows, L2 adoption |

| 2030 | $8,000 | $12,500 | $22,000 | Institutional adoption, scaling solutions |

| 2035 | $15,000 | $25,000 | $50,000 | Web3 infrastructure dominance |

| 2040 | $30,000 | $60,000 | $120,000 | Global settlement layer status |

Note: These estimates assume continued network development and favorable regulatory conditions.

html